Time to Amp Up Digital Customer Experience - A Guide for Fintech Organisations

Shefali Mathur

Managing the customer experience is not just about polite customer conversations during support calls, nor is it limited to lengthy emails (that are often not fruitful). It is about proactively listening to what the customer is looking for and offering a resolution. This includes tracking their conversations online or paying attention to their grievances during calls.

Even a report by Statista states that customer experience today is more than just words. It states that 93% of organisations confirm customer experience either as a “primary” or “partial” competitive differentiator.

This is especially important in critical and sensitive sectors like that of the BFSI industry. Fintech are new members of the age-old BFSI market and thereby, have new rules, new dimensions and of course, new customer demands that need new age resolutions.

Novelty is the name of the game when it comes to managing customer experience in a fintech organisation.

Let’s consider an example. From customer conversations and interactions, finance veteran MasterCard realised they needed to enhance user convenience and customer experience by enabling in-app card management. This in-app card would include features like balance checking, transaction history, and customer support.

They undertook a strategic redesign of the card management section to make it more user-friendly, secure, and efficient, focusing on easy access, quick issue resolution, and reduced friction. This user-centric approach improved convenience, personalised features, security, and overall customer satisfaction, demonstrating.

This is one of the most poignant examples of a great customer experience, service and support where brands focus on discussions and interactions to fine-tune their products and services.

However, it is not easy for many fintech brands, especially those starting out, to manage a huge pool of customers, manage their queries and offer resolutions. This can be done with the help of team alignment and some automation magic.

Let’s read more.

Understanding the Role of Customer Experience in Driving Success

In fintech, making and perhaps more importantly, keeping customers happy is super important. It’s not just about having a nice website or helpful customer service. It’s about making sure every time a customer talks to us, from the first time to whenever they need help, it feels good.

But in fintech, which deals with important data, it’s not only about being good, but it’s also about making customers feel safe. They want customers to trust them with their money and information.

It encompasses every interaction a customer has with a company, from the first touchpoint to ongoing support to the final resolution. After all, selling is just the tip of the iceberg – we need to focus on customer delight.

One of the most incredible examples of focused customer care and engagement is from HDFC Care. A twitter account designated for the bank’s customer queries, this service goes beyond the concept of plain transactions and ensures that customers are aware of security policies, get their queries resolved in real-time and are on top of the latest tips and tricks to stay on top of their financial ecosystem.

Let’s consider a scenario involving a certain mobile banking app. This company provides an online payment system that allows you to send and receive money around the world. However, imagine a critical incident that occurs resulting in a negative customer experience.

A problem occurred when the user saw an unauthorised payment and faced difficulty finding help on the app. When they finally talked to customer support, their service wasn’t helpful enough to fix the issue. This process took a long time and was too complicated. They did not feel cared for as a customer. Now, they are considering switching to a fintech service that treats customers better.

The solution to this problem?

Categorise and prioritise customer queries to ensure each critical remark is catered to and resolved immediately.

Pro Tip: Categorise customer queries based on their critical nature. For a user using a money-based app, unauthorised payment is the biggest nightmare which should be dealt with utmost importance.

Locobuzz helps you prioritise your tickets with the help of its auto-categorisation feature, allowing the top concerns to take priority for immediate resolutions. |

Challenges CX Teams Usually Face in a Fintech Organisation

In a fintech company, customer experience (CX) teams often face various challenges that can make it tricky to keep users happy. From dealing with complex financial processes to handling technical issues, these challenges require smart solutions to ensure customers have a smooth and positive journey.

1) Centralise Your Communication and Collaboration

Creating a customer-centric culture is crucial for fintech organisations to truly master the customer experience (CX). It requires a shift in mindset and a commitment to putting the customer at the centre of every decision and interaction.

One of the main challenges in creating a customer-centric culture is breaking down silos within the organisation. Fintech companies usually have different groups working on their own, and that can make the customer experience a bit confusing.

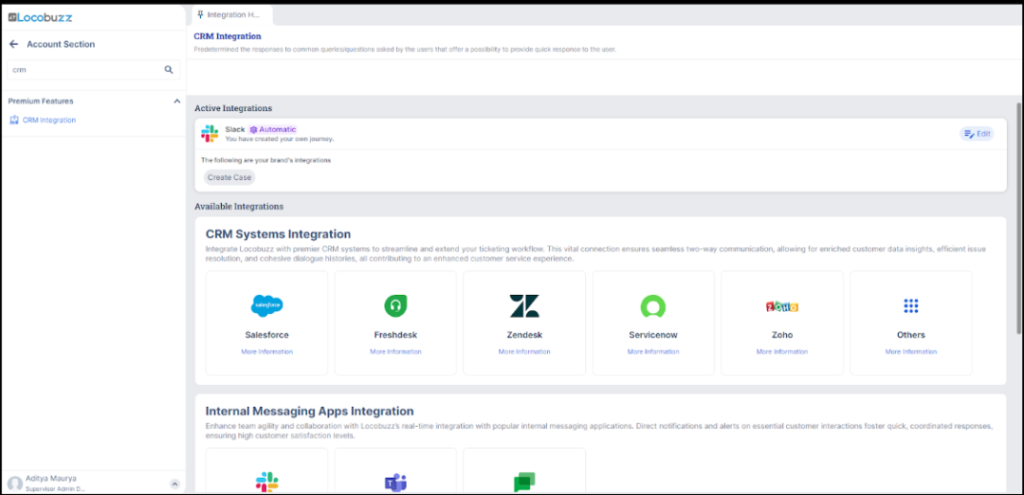

This brings us to the need to connect and collaborate across different messaging platforms. Locobuzz offers multiple CRM integrations that enables your customer experience team to collate all their concerns on one single platform.

One of the primary benefits of this unified approach is there is no customer query left behind. With a centralised approach, your team can address concerns immediately, reduce their resolution time and enhance their response rate multifold.

2) Understanding customer needs and expectations

Fintech companies need to learn more about their customers by doing surveys, talking with them in groups, and testing how they use their services. Empowering employees to deliver exceptional CX is essential. This helps find ways to make things better. It’s also important to train employees so they can help customers well. Additionally, recognising and rewarding employees who go above and beyond to create positive customer experiences can foster a culture of excellence.

3) Implementing technology to enhance CX

Fintech organisations can leverage various technologies to streamline processes, personalise interactions, and create an easy customer journey.

One of the key technologies that can significantly impact CX is artificial intelligence (AI). AI-powered chatbots and reply genies can provide instant support, answer FAQs, and guide customers through complex processes. This not only reduces customer wait times but also enhances self-service capabilities, empowering customers to find solutions independently.

By centralising customer data and enabling a unified view, organisations can ensure consistency and personalise interactions across all touchpoints.

Empowering Teams for Outstanding Customer Service

While technology plays a significant role in delivering exceptional customer experiences, it is important not to forget the importance of well-trained and empowered employees. In the fintech sector, where customer interactions can range from simple queries to complex financial discussions, having knowledgeable and confident employees is crucial.

- Training programs like product and service training, customer interaction skills training should be developed to equip employees with a deep understanding of customer experience in fintech organisations. This will enable them to provide accurate and timely information that meets customers’ needs.

- Additionally, empowering employees to make decisions and resolve issues independently can have a transformative impact on the customer experience.

- Regular feedback sessions and coaching can help employees develop their skills and identify areas for improvement.

Encouraging a customer-centric mindset throughout the organisation will ensure that employees prioritise customer needs and deliver exceptional service at every touchpoint.

Analysing end customer satisfaction and loyalty

In order to continually improve the customer experience within fintech organisations, it is essential to measure and analyse customer satisfaction and loyalty. By gathering feedback from customers, organisations can gain valuable insights into what customers value most and identify areas for improvement.

Surveys: One effective way to measure customer satisfaction is through the use of surveys. These can be conducted after interactions with customers to gauge their level of satisfaction. Customers can be asked to rate their overall experience as well as specific aspects such as the helpfulness of employees or the ease of using digital platforms.

Reports: Analysing the data should be a regular practice within fintech organisations. By doing so, organisations can identify trends and patterns that can inform strategic decisions and improvements to the customer experience. This allows organisations to continuously refine their customer service strategies and ensure that they are meeting the needs and expectations of their customers.

Locobuzz offers a fully-fledged and interactive report to help you and your team understand the data source, performance analytics and everything in between to help you make the strategic decisions imperative for your business growth.

YouTube Link to Locobuzz’s Advanced Workplace Analytics

Or alternatively, brands can also go for Locobuzz solutions to check the sentiments of their customers online, the CSAT (customer satisfaction) scores, and NPS (Net Promoter Score). This would give a pretty detailed insight into how well your fintech brand is perceived.

Final Thoughts

Leveraging technology, especially through data analytics and artificial intelligence, is key to gaining insights into customer behaviour and anticipating their needs, providing a significant competitive advantage.

Beyond technology, creating a customer-focused culture, prioritising empathy, responsiveness, and ongoing improvement, and encouraging employees to take initiative in enhancing customer experiences are essential.

With Locobuzz’s Unified CXM Solution